Frequently Asked Questions

Answers to the following frequently asked questions are accessed by clicking on the individual question:

You have a choice for your checking account: Summit Checking is a high yield account which means you earn 6.00% APY* on your balance up to $10,000...that can add up to $600 annually. Cash Back checking is just what the name says - you get 6% cash back each month on your first $100 of debit card purchases.** If neither is a fit for you, talk to a Cinfed representative - there are other checking options that could meet your needs.

With a Cash Back account, when you meet the monthly qualifications, you get 6.00% cash back rewards on debit card transactions up to $6.00 per month. Plus you get refunds on your ATM fees, up to $20.

With Summit Checking, when you meet the monthly qualifications, you earn up to 6.00% APY* on balances up to $10,000 and 0.50% APY* on balances over $10,000. Plus you get refunds on your ATM fees, up to $20.

Yes - there is no monthly fee or charge for the account. There are no fees tied to minimum balances. Account holders also receive their first debit card for free.

During the monthly qualification cycle, complete 12 debit card transactions, receive eStatements, and log into your Digital Banking account.

No worries! Checking accounts are always free and you can qualify for rewards again the next cycle. If you have Summit Checking, you'll earn our base dividend rate of 0.05% APY* for the unqualified month.

You might have an outdated browser or mobile app, here are a few items to check:

- If you are using an old website saved in favorites or bookmarked.

- If you are using a saved password in the field or used copy and paste.

- If you are using the old/outdated app.

Browser Requirements for Cinfed Digital Banking

The supported browsers are for use with the traditional online banking interface and devices (desktop/laptop), and do not apply to use with mobile devices (phones/tablets). If using a phone or tablet to access online banking outside of an app, functionality and appearance may vary from the traditional interface.

To ensure your online banking access is secure and optimally functioning, the following is recommended:

Desktop Browsers

- Edge: 2 most recent versions; Download here

- Mozilla Firefox: 2 most recent versions; Download here

- Google Chrome: 2 most recent versions; Download here

- Safari: 2 most recent versions; Download here

Mobile Browsers

Online banking is designed to work with touch-based operating systems commonly found on tablet devices. We support the following tablet based operating systems:

- Chrome for Android: 2 most recent versions

- Mobile Safari for iOS devices: 2 most recent versions

Browser Features

The following features need to be enabled in your browser:

- Javascript (View instructions for your browser):

- Cookies (View instructions for your browser):

You might not have two-factor authentication set up. Call us at 513-333-6349.

This may be caused by a delayed refresh setting in Yahoo Mail. Yahoo Mail inboxes do not display emails as they come in, instead it refreshes every 10 minutes to display emails received during that time.

Although the refresh setting rate can't be adjusted in Yahoo Mail, there is a way to manually refresh. Check out the steps below to refresh your inbox.

Using a web browser on a computer:

- Hover your mouse over “Inbox” in the left panel.

- Click "Inbox".

- Your inbox is refreshed.

Using the app on a mobile device:

- Go to your Inbox.

- Swipe down from the top of the screen.

- A refresh icon will appear (circled in the screenshot) then lift your finger from the screen.

- Your inbox is refreshed.

We recommend users login using the latest version of Chrome, Edge, Safari, or Firefox. If you believe your browser is outdated, please update, and try again. If you are using Internet Explorer, please use a different browser as Internet Explorer is not a supported browser. Be sure to delete Cinfed from your Favorites or saved sites.

See question, "What browsers are recommended?" for more information.

Browser Requirements for Cinfed Digital Banking

The supported browsers are for use with the traditional online banking interface and devices (desktop/laptop), and do not apply to use with mobile devices (phones/tablets). If using a phone or tablet to access online banking outside of an app, functionality and appearance may vary from the traditional interface.

To ensure your online banking access is secure and optimally functioning, the following is recommended:

Desktop Browsers

- Edge: 2 most recent versions; Download here

- Mozilla Firefox: 2 most recent versions; Download here

- Google Chrome: 2 most recent versions; Download here

- Safari: 2 most recent versions; Download here

Mobile Browsers

Online banking is designed to work with touch-based operating systems commonly found on tablet devices. We support the following tablet based operating systems:

- Chrome for Android: 2 most recent versions

- Mobile Safari for iOS devices: 2 most recent versions

Browser Features

The following features need to be enabled in your browser:

- Javascript (View instructions for your browser):

- Cookies (View instructions for your browser):

The password must contain:

- 10-20 characters

- one upper case letter

- one lower-case letter

- a number

- a special character

Temporary passwords now expire in 2 hours.

Users are required to update their password once every 12 months. Usernames are not currently required to update. Users can opt to change either the password or username as they wish while logged into the Digital Banking site.

Your member/account number is listed in the welcome packet you received when you first opened your account with Cinfed. You can also call our Member Services Department (513-333-3800) who can retrieve the number for you.

The eStatement service lets you electronically view your statement of accounts and will take the place of your mailed paper statements. Have peace of mind knowing that eStatements will always be available for you wherever you are. Plus, you have the option to print the statements for future reference. Sign up for eStatements in Digital Banking today!

To view your statements from your desktop:

- Log in to Online Banking

- Select the 'More' button

- Click the 'eDocuments' button

- If you are not registered, you can enroll via the 'Statement Settings' box. If you are currently enrolled, your statements will appear here.

- Select your account number from the dropdown box and then select the 'View Statements' (button)

- You will then be led to the 'What's New' page. Here, you can find:

- Statement Library - Here is where we'll keep all your statements for you. Statements are retained online for a rolling period, beginning with the month in which you enrolled

- My Documents - Find NSF/OVERDRAFT NOTICES and 1098 tax documents here. Tax documents for the previous tax year will be available by January 31st of the current year.

- My Virtual FI - Find eBrochures, current promotional information and all the legal stuff here. If you need, there's even a way to Contact Us with your questions or comments.

To view your statements from your mobile device:

- Log in to Online Banking

- Select the 'More' button

- Click the 'eDocuments' button

- If you are not registered, you can enroll via the 'Statement Settings' box. If you are currently enrolled, your statements will appear here.

- Select your account number and then select the 'View Statements' (button)

- Click on the set of three lines in the upper left corner.

Here, you can find:

Statement Library - Here is where we'll keep all your statements for you. Statements are retained online for a rolling period, beginning with the month in which you enrolled

My Documents - Find NSF/OVERDRAFT NOTICES and 1098 tax documents here. Tax documents for the previous tax year will be available by January 31st of the current year.

My Virtual FI - Find eBrochures, current promotional information and all the legal stuff here. If you need, there's even a way to Contact Us with your questions or comments.

The account may be hidden. To unhide an account please login online, go to your 'Settings', select the 'Accounts' tab and unhide any accounts you prefer to see.

The account profile may also be tied to the Primary or Joint owner - this will take some minor configuration to reassign the profile. Please call our eservices department at 513-333-6349 for further assistance.

- Login to online banking

- Select the ‘Transfers’ icon

- Click on the ‘Classic’ tab

- From there, you will have the option to select which account you want to move the funds from to make your payment.

- Login

- Select the ‘Transfers’ icon

- Click on the ‘Classic’ tab

- You will see a link that says “Add an External Account”. Click the link.

After accepting the disclosure, you will need to provide:

- Account number of the account you would like to add

- Routing number of the financial institution

Once completed, your information will be saved and you should see the account available in the dropdown menu.

If you are receiving an error message when transferring funds, check the following items.

For internal transfers:

- Outdated app/browsers – See browser requirement question for more information.

For external transfers:

- You must set up the transfer in the 'Transfer' tab, not under the 'External Accounts' option.

Test deposits need to be confirmed. You must verify that the deposit hit the correct external account.

The other institution may require another Multi-Factor Authentication step. Please select the red “I” next to your balance and follow the steps. It may take up to 24 hours for this to resolve itself.

Check out question "How to do I link external accounts?" for more information.

If you are having trouble getting past the account linking portion, it may be an issue on the other institution’s side. Please contact their customer service.

For most remote deposit users, a small portion of the check will be immediately released. The remainder of the funds will stay on hold until reviewed by our eServices department. If it is determined a hold is not needed the funds will be available by 4:30 pm (Monday - Friday).

Get started:

- Login to online banking

- On your home Dashboard, you will see an area to the right titled 'Link Your Accounts', select the ‘Get Started’ button

- Search and select your financial institution.

- After you've selected, you will be prompted to enter in the credentials you use to log in to that financial institution's online banking.

- Once your credentials have been verified, your account will link and will appear on your Dashboard in the External Accounts section. (This may take up to 24 hours to load)

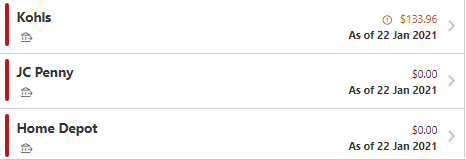

- Each time you log into your account, your external account balances will update automatically. Note: If you see a red number above the account balance, (as seen below) you will need to manually click on that number to start a manual update. That institution has additional security requirements that will need you to provide a SMS code, answer a security question or another type of secondary identification.

A response on the approval process typically takes one to two business days.

Yes, we must have a new credit report with each application.

You may visit one of our branches and complete a form in order to add an authorized user. You also can call us at 513-333-3826 to have the form sent to you.

To qualify for additional funds, you need to complete a new application. You can submit your request, here.

- Log into Cinfed Digital Banking and go to 'Widget Options'

- Click on the 'Contact' tab

- Enter your mobile number (or make sure it’s correct) and check the permission box to receive text notifications

- Go to the 'Card Management' widget and select your card

- Update alert preference under 'Update Alert Thresholds' section then click 'Save Preferences'

We constantly monitor your accounts for fraud, including charges made outside of your routine purchasing area. Please update your account prior to your trip to ensure our fraud prevention systems don’t block credit or debit transactions.

To add a travel notice to your card:

- Log in to Digital Banking

- Click the 'Card Management' widget, set up your card if you haven't yet

- Click your card then hit the arrow down next to 'Travel Notices'

- Fill out 'Travel Notice'

You can also call us at 513-333-3800.

Yes, a 1% conversion fee will be added to any overseas charge on both credit and debit cards.

Simply log into your Cinfed Digital Banking account, click the 'Card Management' widget, select your Mastercard credit card then 'Balance Transfer' to begin. You can also call us at 513-333-3826.

The balance transfer will post within 24 hours after it has been submitted.

Log into your Cinfed Digital Banking account, click the 'Credit Card' widget then the 'Open' button. After you reach the credit card home page, under the 'Statements & Activity' tab, select 'View Transactions'. Find the transaction you would like to dispute then under the 'Actions' column select 'Dispute Transaction' to fill out a dispute form.

Call the lost/stolen line at 1-800-449-7728 as soon as possible if you suspect fraud.

You can find your Annual Percentage Rate (APR) on the 2nd page of your monthly credit card statement.

Interest applies only to your credit card’s outstanding balance at the time your account cycles. Your payment due date is 25 days after the close of each billing cycle. If you pay your entire balance by the due date each month, you won’t be charged interest on your purchases. For cash advance, balance transfer, and convenience check transactions, interest is assessed from the date the transactions post to your account.

Simply log into your Cinfed Digital Banking account, click the 'Credit Card' widget then the 'Open' button. After you reach the credit card home page, under the 'Services' tab, select 'Report Card Lost/Stolen' then begin filling out the report. You can also call us at 513-333-3826.

You will automatically get a replacement card when the lost/stolen report is submitted. You will receive your new card in 7-10 business days.

You can order a new Debit card by stopping by any branch or calling 513-333-3826. You may also order a new Debit card through Card Management in Digital Banking here.

With your new card, the first step is to set up your new PIN by calling 1-866-985-2273. If it’s still not working, call our Contact Center at 513-333-3800 to confirm your account information is correct.

There are no fees associated with using a Cinfed ATM. You can also access surcharge-free any of the 55,000 ATMs nationwide within the Allpoint or Alliance One networks.

If you are using a non-Cinfed ATM, there are 2 types of fees associated with an ATM withdrawal.

- A surcharge fee charged by the ATM owner

- A network fee charged by your financial institution

We reimburse up to $20 per month in total ATM fees for qualifying Kasasa accountholders as well as 2 network fees per month for Cinfed members without Kasasa accounts. (See Kasasa qualifications here)

We do not keep your PIN on file. If you need to reset your PIN, call 1-866-985-2273 and follow the prompts.

Yes, you may make a deposit at ATMs that are part of our participating networks. You may deposit checks or cash at ATMs. Funds may not be immediately available for withdrawal. Visit your nearest Cinfed location or contact us at 513-333-3826 for more information.

In most cases, $1,000 per day. May vary based on the ATM merchant.

Inactive debit cards have no account activity or transactions, meaning they haven’t been used. Inactive debit cards significantly increase fraud and security risks. If a debit card has been inactive for 90 days, a $5.00 monthly fee will be assessed to the account as long as it remains inactive. If a debit card has been inactive for 13 consecutive months, the card will be closed. To avoid inactive status, simply make a purchase or complete an ATM transaction using the debit card at least every 90 days. Cinfed notifies members of inactive debit card status via letter.

Yes, a 1% conversion fee will be added to any overseas charge on both credit and debit cards.

We constantly monitor your accounts for fraud, including charges made outside of your routine purchasing area. Please update your account prior to your trip to ensure our fraud prevention systems don’t block credit or debit transactions.

To add a travel notice to your card:

- Log in to Digital Banking

- Click the 'Card Management' widget, set up your card if you haven't yet

- Click your card then hit the arrow down next to 'Travel Notices'

- Fill out 'Travel Notice'

You can also call us at 513-333-3800.

Cinfed Credit Union serves anyone who lives, works, worships, attends school in or regularly conducts business in 17 counties across Ohio, Kentucky and Indiana.

Ohio: Brown, Butler, Clermont, Clinton, Hamilton, Warren

Kentucky: Boone, Bracken, Campbell, Gallatin, Grant, Kenton, Mason, Pendleton

Indiana: Dearborn, Ohio, Union

To begin the application process, click here to join.

- A government-issued ID with a photo, such as a valid, unexpired driver's license, state-issued ID card, or military ID.

- A second piece of ID, such as a Social Security card, birth certificate, credit card, or other valid identification card with photo.

- A $5 opening deposit, which establishes your main share account.

- Your Social Security Number (SSN) or Tax Identification Number (TIN).

- Proof of valid mailing and physical addresses, if the address provided is different than the one listed on your driver's license or government ID. Acceptable documents include a lease agreement- with signatures, utility bill, or current paystub.

Yes, a minor can become a member with a joint account if the joint member is a parent or guardian over the age of 18.

Your share accounts are insured up to $1,250,000 and your retirement accounts are insured up to $1,250,000 at Cinfed Credit Union.*

*Your deposits are federally insured up to $250,000 by the National Credit Union Association (NCUA) plus Cinfed adds $1,000,000 of private insurance from Excess Share Insurance Corporation (ESI) at no charge.

No, once a member of Cinfed you are always a member of Cinfed. As long as you maintain your $5 balance in an active main share account you will remain a member.

Cinfed's routing number is 242076656.

Log in to Digital Banking, in the top right corner next to your name, select the down arrow then ‘Settings’. Go to the ‘Contact’ tab, change your address then click ‘Save’. You can also stop by any branch or call 513-333-3800.

All of our branch locations have at least one Cinfed ATM. All Cinfed ATMs are free of charge to members. Our members also have access to more than 55,000 surcharge-free ATMs nationwide through the Allpoint and Alliance One networks! To find an ATM near you please click here.

You can set up direct deposit through your employer. You will need your account number and our routing number, which is 242076656.

- If your account earned more than $10 in dividends, you will be mailed a federal 1099-INT form. You can also see the total dividends you earned in your eDocuments widget in Digital Banking if you receive or are enrolled in eStatements.

- If you received an incentive or bonus as part of a Cinfed marketing promotion, the amount will be included in Box 1 on the 1099-INT form.

- If you have an IRA account, you will receive a 1099-R statement for all withdrawals; a 5498 statement will be sent in May for contributions (since contributions for the previous year can be made until Tax Day).

- If your mortgage is through Cinfed, the Mortgage Interest Statement (Form 1098) will be mailed to you. If you have a Home Equity Line of Credit (HELOC), a separate form will be sent. For eStatement holders, statements will also be available online.

ITM stands for Interactive Teller Machine – it’s like an ATM but can do much more! You can connect with a teller via video screen. During business hours, simply pull up and press the on-screen button to connect. A teller will appear to help you with questions or transactions. When the branch is closed, the ITM works like a traditional ATM.

- Cash withdrawals

- Deposits

- Transfer funds

- Get account information

We do not offer payday loans. We DO offer personal loans (with much better rates!) to help get your finances back on track. Click here to find out more.

Yes, members are welcome to pay online using an internal transfer or an external ACH.

You can check the status by calling us at 513-333-3800 or check online here.

Contact our mortgage servicing team at [email protected] or call (513)-333-3881.